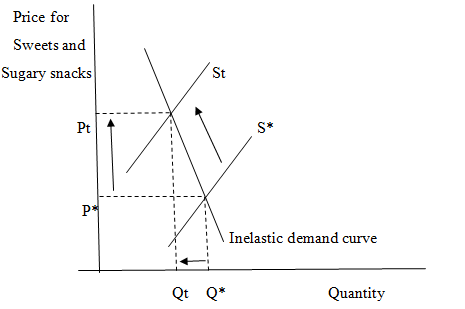

Fig: Elasticity of demand for Sugary food stuffs

A tax on sweets and sugary snacks can have a positive effect of changing the consumers’ behavior from unhealthy to healthy eating. If an assumption is made that the price of these food stuffs before the tax imposition is P* and that a quantity level of Q*, a price increase to a price with tax Pt causes the quantity level to fall to quantity with tax Qt. However, as it can be observed from the diagram above, inelasticity of demand for this food stuffs is making the quantity demanded to fall by a small margin after a big price rise. Thus, taxing this products does not result in a significant behavioral change. Tax alone cannot be effective and I can argue against it. However, a combination of this tax and subsidy could be effective since the money raised through the imposed tax will be sufficient to subsidize the affordability of fruits and vegetables and other food stuffs recommended for healthy eating. If the taxation is supplemented by the subsidy, then I would vote for it. The tax imposition therefore has to be higher to impact the consumers’ behavior; a small tax imposition will result in no change owing to the issue of inelasticity.

The simple idea put down by Keynes has been argued for by many economists and governments have embraced this idea. The simple idea is that increasing the government spending could indirectly stimulate the private investment. The process is as follows; the government spending goes up to investments that creates more jobs for the citizens. With the availability of many jobs, the economy’s income level expands stimulating an increase in demand. Since the supply level has not changed, the price level goes up stimulating the producers to supply more so as to enjoy better profits. At the bottom line, the production level in the economy is stimulated

During a recession, the change in the fiscal position is that the government budget balance becomes a deficit due to the implementation of discretionary fiscal policies. The government has a crucial role of ensuring that they is a significant level of growth at any given time. During a recession, the fiscal policies employed include the raise in government spending and cutting of the taxes. Any of these two policies contributes to the deficit. Tax is the major source of revenue for the government and thus when its cut, revenue falls. Increasing government spending again causes the deficit because already many economies operates at a deficit and supplement the increase in spending from borrowing.

Wasteful spending by the government is consuming much funds that could otherwise be used productively. This explains why the government need to borrow so as to facilitate its increased spending. It has been noted that increased government borrowing results in an increased interest rate which discourages real investment. Thus, if the government directed its spending only to important projects and eliminating the spending on wasteful projects, it would save more of its revenue and reduce its budget deficit. As a result, the interest rate would fall and the investors will be stimulated to invest more. The government will be in a good position to raise spending in the future is need arises.

The creation of economic stimulus through monetary policy could be by increasing the money supply or reduction in the central banks interest rate. Money supply is increase through; cut in reserve ration requirement, open market operations and decreasing short term interest rate. Makin argument is that fiscal policy is not effective for an economy that borrows heavily to finance its spending as it creates risks of falling credit worthiness. For such an economy therefore, Makin noted that the most effective policy is that of monetary actions and he argued for absence of need for a fiscal stimulus is such an economy..

Delivering a high-quality product at a reasonable price is not enough anymore.

That’s why we have developed 5 beneficial guarantees that will make your experience with our service enjoyable, easy, and safe.

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more