Prepare an Investment Portfolio Proposal Document to be Provided to the Client.

Investment Philosophy and Processes are applied by the organization for achieving the following goals such as understanding the behaviour of investor, managing investor expectations, developing the procedure to be applied in Investment Portfolio (Achillas and et.al, 2015). Present report revolves around explanation relating to Investment Philosophy and Strategy in the case when investor have a high level of risk tolerance and an interested investing major portion of the investment in individual equity securities. The further presentation has been provided in the manner in which investment should be made in accordance with specified nature of the investment. The report ends up with the explanation regarding the manner in which investment component aligns with the overall strategy.

Portfolio management strategy assists in increasing profits by managing risk and required returns (Powell, 2015). A forceful strategy of investment force capital approval as a chief objective of investment, instead of principle’s income or safety.

Aggressive strategies of investment are appropriate in the current situation. It is because their extended prospect of investment allows them to persist fluctuation in the market far better for short prospects of horizons by investors (Walker, 2014). In the present scenario, as the client is having high-risk tolerance and interested in investing a major portion of the investment in the equity of high cap companies (Bodie, Kane and Marcus, 2014). Thus, aggressive investment philosophy strategy will be applied for constructing the portfolio. By applying the same, the expected objectives will be achieved in an appropriate manner. Further, capital growth strategy will also be applied as it assists in maintaining the goal of capital growth which consists mainly of equities (Gründl and Gal, 2016). Active management is required by aggressive strategies of investment rather than conservatives, as it is possible to get more unstable and requires constant adjustment to cope up with changing conditions of the market. Regular rebalancing is also needed to maintain allocations of the portfolio to their levels of the target (Yang, Narayanan and De Carolis, 2014). Thus, by applying the above philosophy strategies, investors will be able to attain expected gains.

Table 1: Table representing percentage allocated to different investments in the portfolio

|

Particular |

Amount Allocated |

% |

|

Individual equity securities |

$800000 |

40% |

|

Listed Investment Companies |

$400000 |

20% |

|

Equity market options securities or Future Contract |

$500000 |

25% |

|

Cash |

$300000 |

15% |

|

Total |

$2000000 |

100% |

Table 2: Selected companies for direct investment

|

ASX Code |

Company Name |

GICS Sub-Industry Name |

Current share price |

Percentage |

Amount to be invested |

|

AGL.AX |

AGL Energy Ltd |

GICS Sub-Industry Name |

25.00 |

30% |

$240000 |

|

CTX.AX |

Caltex Australia Ltd |

Multi-Utilities |

31.26 |

20% |

$160000 |

|

DOW.AX |

Downer EDI Ltd |

Oil & Gas Refining & Marketing |

6.18 |

15% |

$120000 |

|

RMD.AX |

Resmed Inc |

Diversified Support Services |

10.11 |

5% |

$40000 |

|

IVV.AX |

iShares S&P 500 |

Health Care Equipment |

320.83 |

20% |

$160000 |

|

AGL.AX |

AGL Energy Ltd |

US S&P 500 |

25.00 |

10% |

$80000 |

|

Total |

100% |

$800000 |

|||

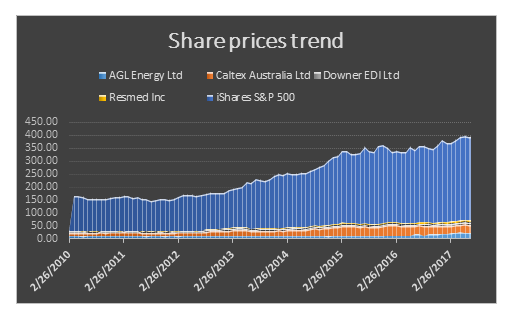

Figure 1: Share price trend for selected companies for investmen

Active management is required by aggressive strategies of investment rather than conservatives, as it is possible to get more unstable and requires constant adjustment to cope up with changing conditions of the market (Fischer and Schlütter, 2015). Regular rebalancing is also needed to maintain allocations of the portfolio to their levels of the target. Thus, cash has also been kept in balance so that in case any requirement regarding purchase or sales of shares occurs for rebalancing the portfolio could be accomplished without any obstacles.

Listed Investment companies are referred as a viable and well-established alternative to managed funds as the same have considerable advantages. In the present scenario, six companies have been selected for the purpose of direct investment (Jagric and et.al. 2015). It can be observed from the graph represented above that all the companies have either increased or stable trend. As the companies belong to high cap group, the company will be able to attain higher profits. The company will also be able to achieve market diversification through investing in LIC’s.

Investment in investment companies refers to providing funding to mutual funds as they are highly qualified and can make better investment decisions. Thus in order to get good returns, part of portfolio contains investment companies having a good reputation in Australia (Ferreira and et.al. 2013). For this purpose top, five companies are selected in which equal investment will be made of concerned category i.e. 20% in each company of $400000.

|

Company |

Symbol |

Last Price |

10-Year return |

|

Carlton Investments Limited |

(ASX: CIN) |

$31.49 |

9.7 |

|

WAM Capital Limited |

(ASX: WAM) |

$2.26 |

9.4 |

|

Australian Leaders Fund Limited |

(ASX: ALF) |

$1.52 |

9.3 |

|

Mirrabooka Investments |

(ASX: MIR) |

$2.82 |

8.2 |

|

WAM Research Limited |

(ASX: WAX) |

$1.52 |

6.7 |

Investment in this option is wise strategy to protect, grow and diversified share portfolio to maximise wealth of shareholders. By considering this factor, 25% of portfolio amount is invested in equity market options securities and Future Contract. In this option, full value of contract is not to be paid on upfront basis and at the time of maturity of contract difference is price is to be paid (Bodie, Kane and Marcus, 2014). Investment will be done in Sydney Futures Exchange (SFE) in S&P 500 E-Mini (Sep ’17) and 3 year Bond futures to ensure price stability and secured returns.

Cash can be said as a key variant in the well-diversified portfolio, and a variety of objectives can be accomplished with same. These objectives comprise greater stability, potential inflation protection and diversification. Cash plays an important role in investor’s portfolio as it assists in creating liquidity as investors can withdraw it the same in a situation of market insolvency or closed stock exchanges, as making asset insolvency unattainable. Cash is kind of insurance policy; through which investor is independent to purchase assets and to pay out the bills when they are outstanding (Duchin and et.al. 2017). One more role of cash in investor’s portfolio which is considerably psychological. It can attach investor to the investment strategy by all kind of political and market conditions through offering peace to mind (Cardella, Fairhurst and Klasa, 2016). In situation; investors take a look at data sets; they can examine thoroughly historical instability outcomes for various compositions of the portfolio. Meaning full cash allocation provides stability for decreasing the down side risk. In the present scenario, appropriate 15% of investment has been kept as a cash reserve for accomplishing these objectives.

It can be depicted from above analysis that aggressive strategy is appropriate in case the company has high-risk tolerance capability. Further, in compliance with strategies of Donald Trump as it is expected that US economy has bullish nature; a major portion of investment has been made in equity investment so that maximum returns from same can be achieved. Further, a limited portion has been invested in listed securities so that some fixed profits from same can be attained. Investment has also been made in Future Contract; the amount invested so is safe and will be applied only in case higher returns are expected. A portion of investment amount has remained available as cash, and the same will be applied for reconstructing portfolio. It can also be utilized for attaining benefit by selling or purchasing shares.

Achillas, C., Aidonis, D., Iakovou, E., Thymianidis, M. and Tzetzis, D., 2015. A methodological framework for the inclusion of modern additive manufacturing into the production portfolio of a focused factory. Journal of manufacturing systems, 37, pp.328-339.

Bodie, Z., Kane, A. and Marcus, A.J., 2014. Investments, 10e. McGraw-Hill Education.

Cardella, L., Fairhurst, D.J. and Klasa, S., 2016. What Determines the Composition of a Firm’s Total Cash Reserves?.

Duchin, R., Gilbert, T., Harford, J. and Hrdlicka, C., 2017. Precautionary savings with risky assets: When cash is not cash. The Journal of Finance, 72(2), pp.793-852.

Ferreira, M.A., Keswani, A., Miguel, A.F. and Ramos, S.B., 2013. The determinants of mutual fund performance: A cross-country study. Review of Finance, 17(2), pp.483-525.

Fischer, K. and Schlütter, S., 2015. Optimal investment strategies for insurance companies when capital requirements are imposed by a standard formula. The Geneva Risk and Insurance Review, 40(1), pp.15-40.

Gründl, H. and Gal, J., 2016. The evolution of insurer portfolio investment strategies for long-term investing. OECD Journal: Financial Market Trends, pp.1-55.

Jagric, T., Podobnik, B., Strasek, S. and Jagric, V., 2015. Risk-adjusted performance of mutual funds: some tests. South-eastern Europe journal of Economics, 5(2).

Powell, R., 2015. Takeover prediction models and portfolio strategies: a multinomial approach.

Walker, S.T., 2014. Understanding Alternative Investments: Creating Diversified Portfolios that Ride the Wave of Investment Success. Palgrave Macmillan.

Yang, Y., Narayanan, V.K. and De Carolis, D.M., 2014. The relationship between portfolio diversification and firm value: The evidence from corporate venture capital activity. Strategic Management Journal, 35(13), pp.1993-2011.

Delivering a high-quality product at a reasonable price is not enough anymore.

That’s why we have developed 5 beneficial guarantees that will make your experience with our service enjoyable, easy, and safe.

You have to be 100% sure of the quality of your product to give a money-back guarantee. This describes us perfectly. Make sure that this guarantee is totally transparent.

Read moreEach paper is composed from scratch, according to your instructions. It is then checked by our plagiarism-detection software. There is no gap where plagiarism could squeeze in.

Read moreThanks to our free revisions, there is no way for you to be unsatisfied. We will work on your paper until you are completely happy with the result.

Read moreYour email is safe, as we store it according to international data protection rules. Your bank details are secure, as we use only reliable payment systems.

Read moreBy sending us your money, you buy the service we provide. Check out our terms and conditions if you prefer business talks to be laid out in official language.

Read more